PM Jan Dhan Yojana: If you have also opened a Jan Dhan account in any bank under PM Jan Dhan Scheme then good news is for all of you. So let us tell you that ₹ 2000 will be added in your Jan Dhan account soon. In today’s article we will tell you how you can get the benefit of Jan Dhan scheme provided by government.

Let us tell you that Pradhan Mantri Jan Dhan Scheme is a special financial scheme run by government. Main objective of which is to connect all the people with ATS services. Let us tell you that in today’s digital time it is seen that people of rural areas are still not connected to bank. So for this purpose government has started Jan Dhan Scheme. So that all the people living in rural areas can connect with all the banks and can take advantage of the facilities provided by banks.

Overview of PM Jan Dhan Yojana

| Article Name | PM Jan Dhan Yojana |

| Launched By | Govt. of India |

| Beneficiary | Citizen of India |

| Scheme Year | 28 August 2014 |

| Official Website | Click Here |

E Shram Card Pension Scheme: Rs.3000 Pension Per Month to Labour

Pradhan Mantri Jan-Dhan Yojana Official Portal: Apply Online

Objective of PM Jan Dhan Yojana

Financial Inclusion: We will tell you that the main purpose of Pradhan Mantri Jan Dhan Yojana is to connect those who were not having banking services till now to the banking system.

Zero Balance Account: We will tell you that accounts opened under this scheme can be opened with zero balance.

RuPay Debit Card: We will tell you that every Jan Dhan account holder gets a RuPay debit card. In which they can do transactions easily.

Accident Insurance: We will tell you all that an account opened under Pradhan Mantri Jan Dhan Yojana is covered with accident insurance of up to ₹ 100000.

Overdraft: All Jan Dhan holders are also getting overdraft facility on certain conditions.

Features of PM Jan Dhan

Universal access: We will tell you all that the objective of this scheme is to have at least one bank account in every household.

All Jan Dhan account holders were getting financial help every month during Corona period. So today we are talking about the scheme through which you will get ₹ 2000 in your Prime Minister Jan Dhan account immediately. Below is the details.

How to Get Rs.2000 in Account Through Jan Dhan Yojana

We will tell you that people having account under this scheme are getting many benefits from government. We will tell you that one of the biggest benefit among all these benefits is that even if you have zero balance in your account, you will get money from banks as overdraft without any problem. We will tell you that under the scheme you will get overdraft amount from ₹ 2000 to ₹ 10000 from bank.

We will tell you all that this facility will be given only to Jan Dhan account holders. So if you have also opened account in any nationalized bank under Jan Dhan scheme then you will get this overdraft facility.

FAQ Related PM Jan Dhan Yojana

What is the goal of PMJDY?

What are the features of PMJDY accounts?

No minimum balance

₹2 lakh accidental insurance for new RuPay card holders

₹30,000 life insurance

Overdraft of ₹10,000 after 6 months of satisfactory conduct of account

Can open account without KYC documents

Any individual can open account, including minors and non-residents

Joint accounts allowed

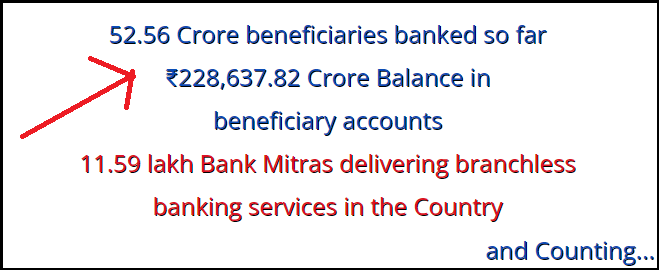

Where are we?

Who has benefited from PMJDY?

What are the issues in PMJDY?

Active usage of accounts and prevent dormancy

Financial literacy and credit counseling to account holders

Banking correspondents in remote areas

Simplify account opening and KYC verification process

Infrastructure and technology support for seamless banking

Despite these issues, PMJDY is a big step towards financial inclusion and empowerment of economically weaker sections of the society in India.